#1 Way To Save Money On Taxes For Your Small Business This Year…

BUT YOU HAVE TO ACT FAST...

It’s time to take a hard look at your current IT infrastructure and consider the best way to save while upgrading your technology for years to come!

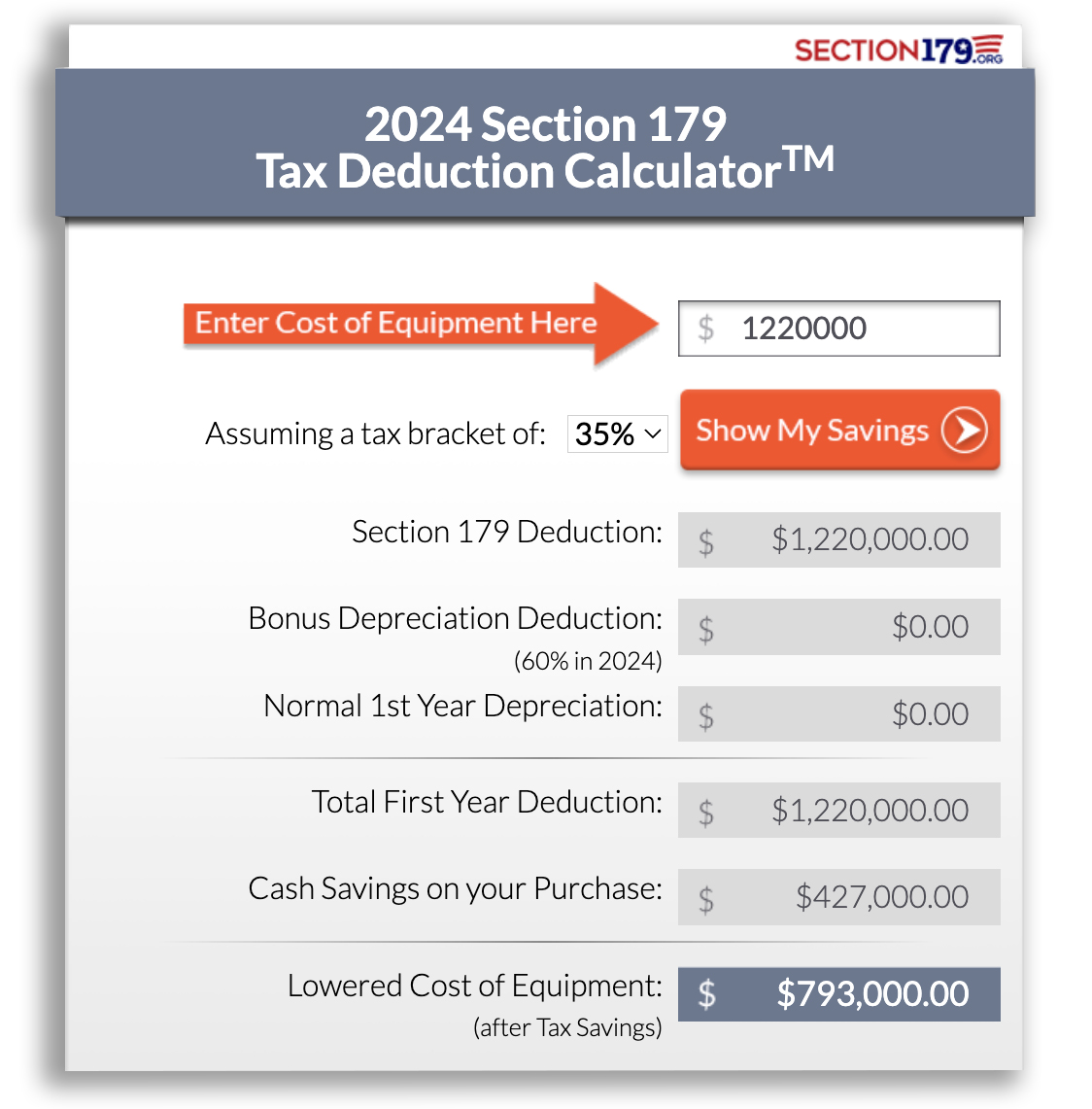

Thanks to a recently updated tax deduction titled “Section 179 Election”, the Federal Government now allows you to buy up to $1,220,000 in machinery, computers, software, office furniture, vehicles, or other tangible goods and thereby REDUCING your taxable income on your current year’s tax return.

How can you use this to your advantage? Does your office use Windows 10?

Microsoft will officially end support for Windows 10 on October 14, 2025, but waiting until the last minute to upgrade can expose your business to cybersecurity risks and system compatibility issues. Upgrading your technology now not only ensures you’re secure and compliant but also lets you take advantage of year-end savings and tax incentives.

The official IRS - Section 179 website has a calculator that can give you an example of an estimate your business could use to boost your bottom line for the year!

But to get the deduction for tax year 2024, you must act now, as once the clock strikes midnight on 12/31/2024, Section 179 can't help your 2024 profits anymore.

But that’s not the only way you’ll save money...

Manufacturers and vendors are ALSO giving year-end discounts, rebates, & incentives

Most IT vendors and manufacturers offer incredible rebates and discounts on equipment toward the end of the year in a last-ditch effort to improve their annual sales. After all, they need to look good to their investors!

So, if you are going to need a network upgrade soon, you can not only get better deals on software and equipment, but you can also get the generous tax savings making this a double dip on saving money. Fill out the form below to start the discussion how to upgrade and secure your technology while saving the max amount on your taxes.

After all, no one wants to hand over one penny more to the government than is necessary and no one wants to pay MORE for services and products than they must. We all work way too hard for that!

With 25 years of IT services in Dallas and Fort Worth, we are confident in our ability to help guide, support, maintain, and protect our clients.

Fill This Form Out

IMMEDIATELY

To Claim Your Savings

DEADLINE

12/31/2024

Fill This Form Out

IMMEDIATELY

To Claim Your Savings

DEADLINE

12/31/2024